Ripple price is in a strong bull run, fueled by positive momentum and favorable ecosystem developments.

Ripple (XRP) has risen for four consecutive weeks, reaching $1.70, its highest level since May 2021. The token has surged by over 240% this month, pushing its market capitalization above $96 billion.

XRP’s rally stems from strong fundamentals, including significant legal victories and favorable political developments. Ripple won a major court case against the SEC in July last year, followed by a court ordering the company to pay $250 million. This represents a much smaller figure than the $2 billion initially sought by the SEC.

The SEC has signaled a potential appeal, but optimism is growing that the incoming SEC Chair may not pursue further action. Reports suggest President-elect Donald Trump is considering Paul Atkins, a former commissioner with a pro-crypto stance, as the next SEC chair.

Investors are also bullish on upcoming potential catalysts. These include the possibility of a spot XRP ETF approval, anticipated under the next administration, and Ripple Labs’ potential Initial Public Offering.

Additionally, Ripple is developing a stablecoin called RLUSD which is backed 1:1 to the US dollar. Expectations are this venture could significantly boost the ecosystem’s revenue.

XRP price is getting overbought

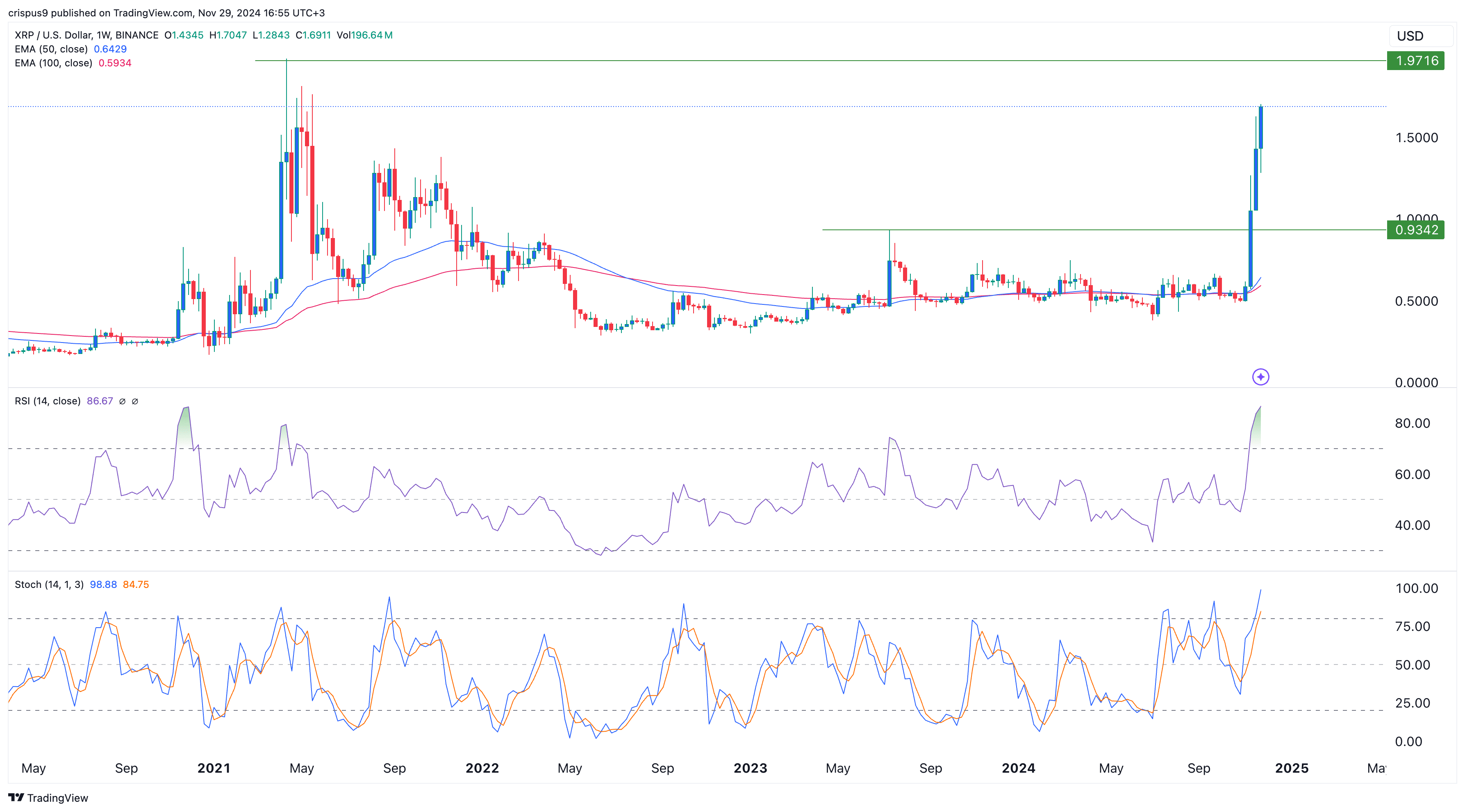

The weekly chart reveals a strong uptrend for Ripple in recent weeks. The token recently broke past key resistance at $0.9340, its highest level in July 2023. It also surpassed the psychological $1 mark and the 50-week and 100-week moving averages.

However, technical indicators suggest caution. The Relative Strength Index and Stochastic oscillator have moved into overbought territory, signaling the potential for a brief retracement in the coming days.

The next potential target for the XRP price is $1.9716, its April 2021 high, followed by $2. In the long term, as Bitcoin (BTC) has done, Ripple could jump to a record high of $3.5, which is about 110% above the current level.

Source link

Palmer Legals Reaching Your Expectation

Palmer Legals Reaching Your Expectation