Average crypto trading volume more than doubled across centralized exchanges like Binance, Kraken, and Coinbase in November.

Following Donald Trump’s re-election, data revealed a significant surge in crypto spot and derivative trading volumes on several digital asset platforms. South Korea’s Upbit emerged as last month’s top performer, with a 386% increase in crypto spot trading volume. BitMart and Bitfinex also saw substantial growth, recording increases of 242% and 218%, respectively.

Binance’s trading volume grew by 131%, reaching nearly $1 trillion in November, while Coinbase nearly tripled its spot trading numbers with a 189% spike in user activity. Website traffic further indicated a return of retail demand, with Crypto.com, Coinbase, and Upbit experiencing traffic increases of over 82%.

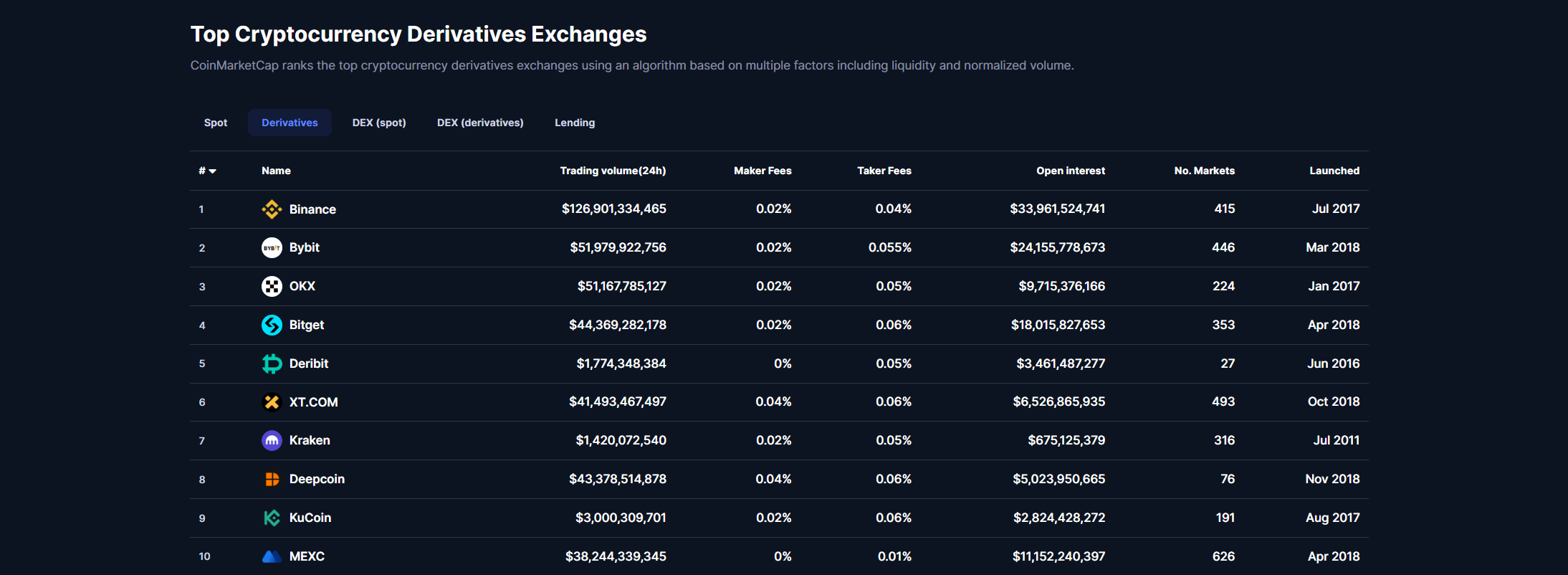

In November, professional traders and speculators poured more capital into derivatives than in October. Derivatives, which are financial products based on the value of other assets, saw a threefold increase in perpetual contract trading on platforms like MEXC, Kraken, and Deribit, a top-five derivatives exchange according to CoinMarketCap.

Confirmed increments in crypto spot trading, digital asset derivatives volume, and exchange website traffic affirmed the palpable bullish momentum noted after the U.S. general elections. Renewed crypto trading translated to huge capital inflows in crypto majors like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Ripple (XRP), and Binance Coin (BNB), to mention a few.

Stablecoin circulating supply crossed $200 billion, grown by demand for fiat-pegged tokens issued by firms like Tether (USDT) and Circle (USDC).

The total crypto market rose above $3.2 trillion for the first time last month as Bitcoin broke into the six-figure club and usurped legacy assets like Silver. Crypto markets were undaunted by profit-taking after Bitcoin hit a new all-time high in early December. Indeed, the total digital asset market settled at around $3.6 trillion amid broad cryptocurrency recoveries.

Source link

Palmer Legals Reaching Your Expectation

Palmer Legals Reaching Your Expectation