Bitcoin price has encountered strong resistance around the $100,000 level amid profit-taking by retail investors.

Bitcoin (BTC), the biggest cryptocurrency, was trading at $98,900 on Dec. 11, lower than the all-time high of about $104,000.

Crypto analysts believe the coin has more upside potential as demand continues to grow while supply diminishes. In a recent piece, the Wall Street Journal noted that the coin’s supply was one of the primary reasons why it will continue rising in value.

Bitcoin’s supply is capped at 21 million coins, with over 19.7 million already mined, leaving only 1.3 million yet to be created. Furthermore, millions of coins have been lost and are unlikely ever to be recovered.

Additionally, significant portions of Bitcoin are held by entities unwilling to sell, such as MicroStrategy and Marathon Digital.

The amount of Bitcoin on exchanges has continued to decline, now standing at approximately 2.24 million, down from 2.7 million in January. Meanwhile, Bitcoin’s mining difficulty has risen since the last halving event.

Meanwhile, Bitcoin demand is rising, as evidenced by the ongoing inflows in the exchange-traded funds industry. Inflows have crossed the important level at $34 billion, higher than what most analysts were expecting. These funds now hold assets worth over $107 billion.

Crypto analysts remain optimistic about Bitcoin’s future price performance. In an X post, Ali Martinez, a popular cryptocurrency analyst, projected that Bitcoin could eventually rise to $275,000. If accurate, this forecast implies a 177% increase from current levels.

Other analysts are also upbeat. In a note, analysts at Bitwise predicted that Bitcoin could reach $200,000 by 2025 as ETFs attract more inflows. They also projected that Bitcoin might surpass gold’s $18 trillion market cap by 2029.

Bitcoin price analysis

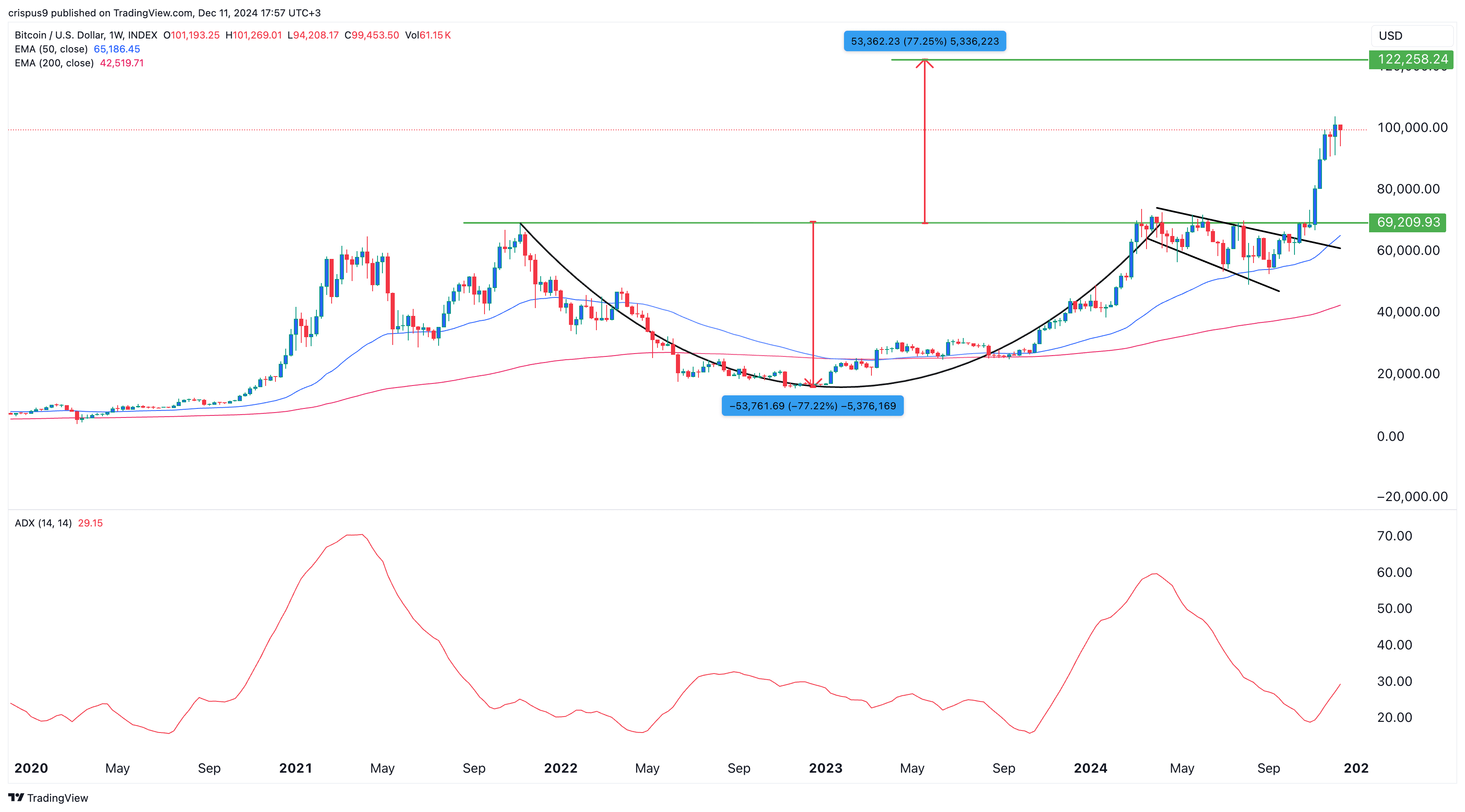

The weekly chart shows that the BTC price has made a strong bullish breakout in the past few weeks. It recently crossed the important resistance level at $69,210, the upper side of the cup and handle pattern.

Bitcoin price has remained above the 50-week and 200-week Exponential Moving Averages, which made a golden cross in April 2023. It also has the momentum as the Average Directional Index has tilted upwards.

Therefore, the coin will likely continue rising as bulls target the key resistance level at $122,258.

Source link

Palmer Legals Reaching Your Expectation

Palmer Legals Reaching Your Expectation