Cardano price has crashed by over 20% from its highest point this year, and one legendary trader believes that it has more downside to go.

Cardano (ADA), a popular layer-1 coin, retreated to $0.90, much lower than the year-to-date high of $1.326.

Peter Brandt, a legendary trader who has written widely on technical analysis, warned that the coin may continue falling in the near term.

He pointed to Cardano’s head and shoulders chart pattern that has formed on the daily and four-hour chart. A H&S pattern is made up of two shoulders, which are at $1.153, and a head at $1.327. It also has a neckline at $0.914.

A H&S pattern often leads to a strong bearish breakdown. In most cases, the target of this breakdown is usually the same as the distance between the head and the neckline. Therefore, if Brandt is accurate, it means that Cardano price will crash to $0.629, which is a few points below the 61.8% Fibonacci Retracement level. That price is about 32% below the current level.

Cardano has weak fundamentals

Third-party data show that Cardano has weak fundamentals, which explains why it is lagging behind other layer-1 networks like Solana and Ethereum.

Data by DeFi Llama shows that Cardano’s DeFi total value locked has moved from over $700 million in November to $478 million today. The decline has also happened in ADA terms as the TVL fell from the year-to-date high of 670 million ADA to 494 million.

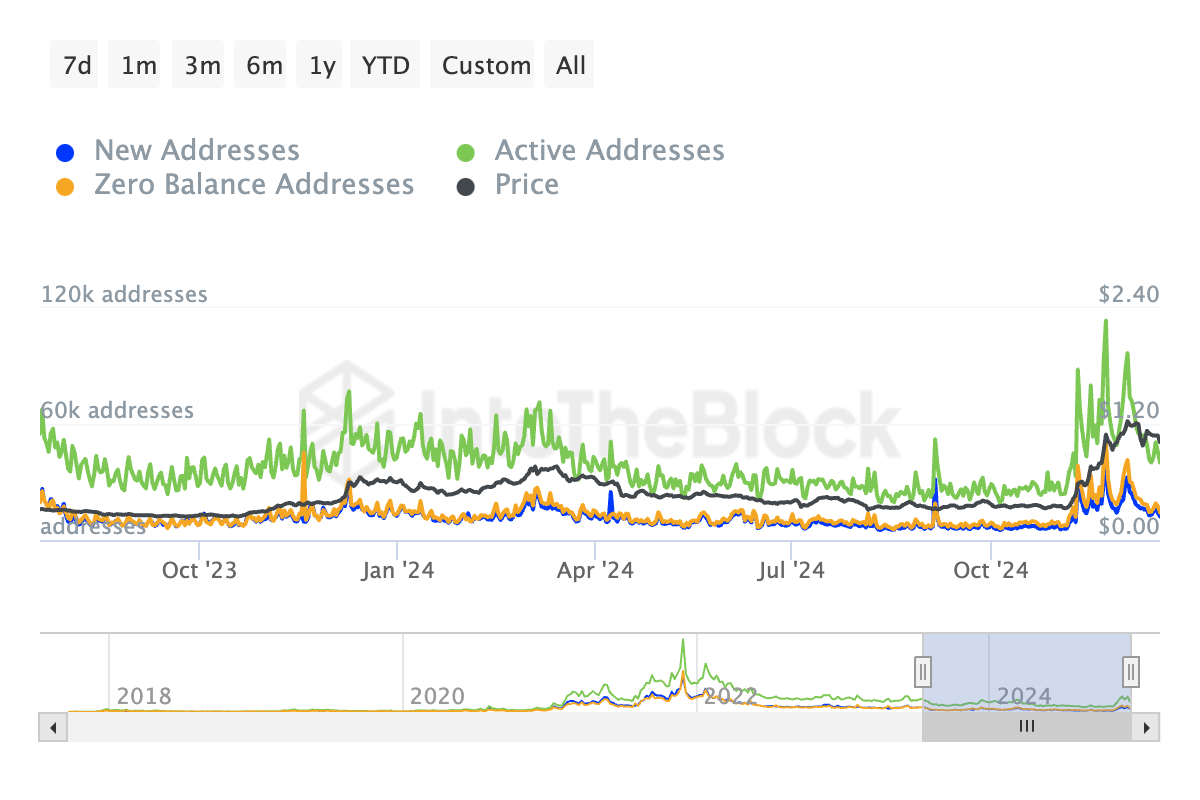

Meanwhile, data by IntoTheBlock shows that the number of Cardano addresses has continued to fall after peaking in November as the coin rallied. Cardano had almost 210,000 daily active addresses in November 2023, a figure that has dropped to 66,500.

Cardano’s futures open interest has also been in a downward trend, a sign that its demand in the futures market is falling. Its interest fell to $775 million on Thursday, down from the year-to-date high of over $1.1 billion.

Futures open interest is an important metric that looks at the volume of unfilled put and call options orders in the futures market. The figure often rises when there is substantial demand for a coin.

Source link

Palmer Legals Reaching Your Expectation

Palmer Legals Reaching Your Expectation