Ripple and TRON posted over 50% weekly gains and the two altcoins could continue their climb in the altcoin season. As Bitcoin slips under the $100,000 level, it dragged altcoins down with a market-wide correction on Friday.

XRP (XRP) and TRON (TRX) could recover and extend the rally next week, according to on-chain and technical indicators.

Bitcoin erases recent gains, slips under $100,000

Bitcoin’s rally to a new all-time high above the $100,000 milestone, at $104,088 was fueled by consistent institutional capital inflows to Spot BTC ETFs, and pro-crypto developments in the U.S (BTC).

The largest cryptocurrency pulled back shortly after, down nearly 6% from its all-time high. Altcoins reacted to the development, and a market-wide correction followed. Most alts in the top 20 erased between 1 and 5% of their value within a 24-hour period.

Analysts at Crypto Finance, a part of the Deutsche Börse Group, believe that the catalyst for the surge in BTC was Fed Chair Jerome Powell’s remarks at the DealBook Summit, where he compared bitcoin to gold rather than the US dollar.

XRP and TRON could extend rally as altcoin season persists

The altcoin season index at Blockchain center signals that it is “altcoin month.” Altcoin season persists as 75% of the top 50 altcoins continue to outperform Bitcoin over a 90-day time period. The indicator reads 86 on a scale of 0 to 100.

XRP and TRON gained nearly 50% on the weekly timeframe, per TradingView data. The two altcoins could extend their gains as the altcoin season persists.

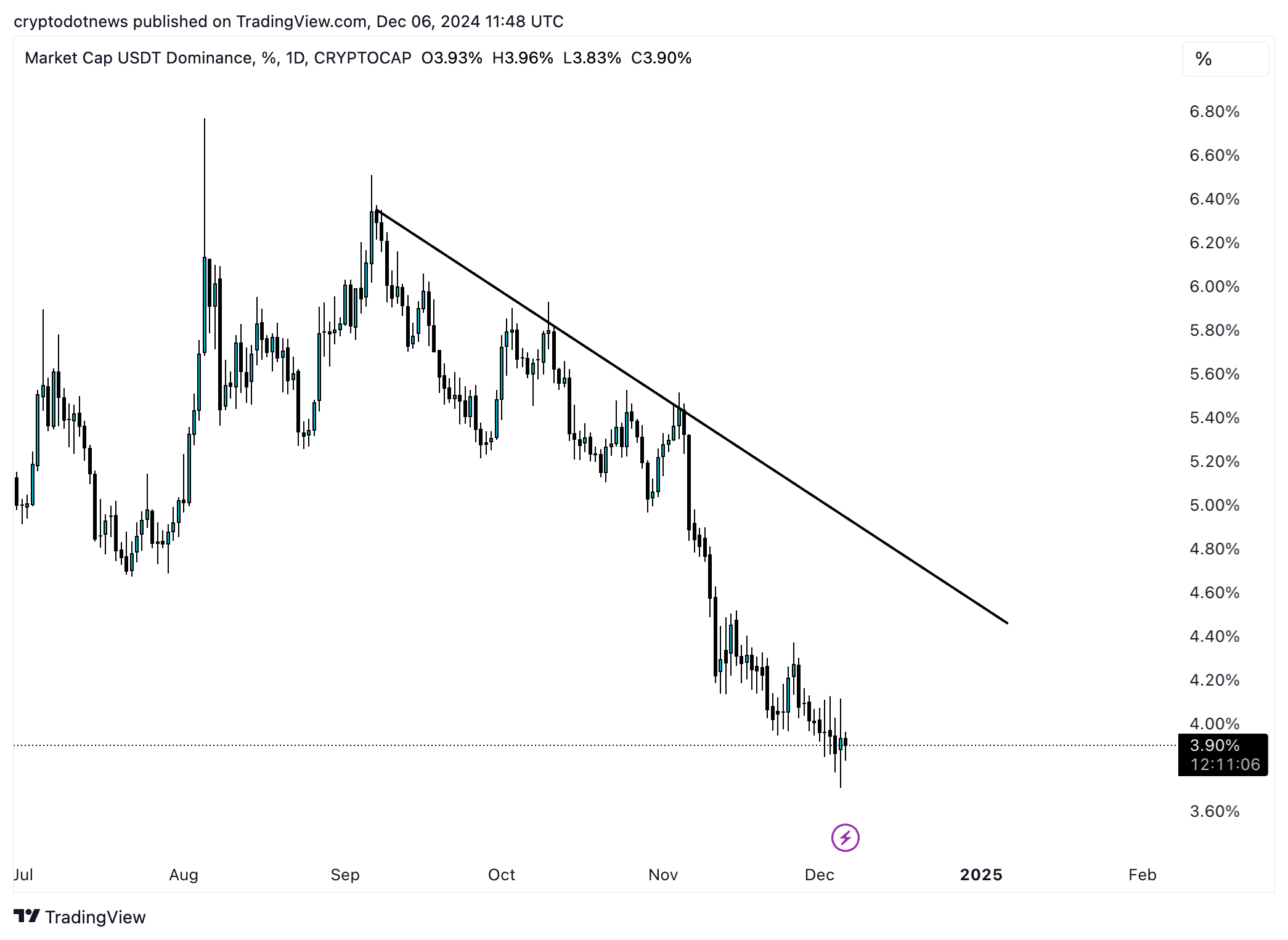

Tether (USDT) dominance is at 3.91%, meaning traders are likely rotating their capital from stablecoins to cryptocurrencies and altcoins. USDT dominance has been in a downward trend since September 2024.

Traders need to watch the USDT dominance chart closely for signs of a trend reversal or consolidation. If USDT dominance starts climbing again, it could signal a surge in profit-taking or capital flowing out of Bitcoin and altcoins.

On-chain and technical analysis

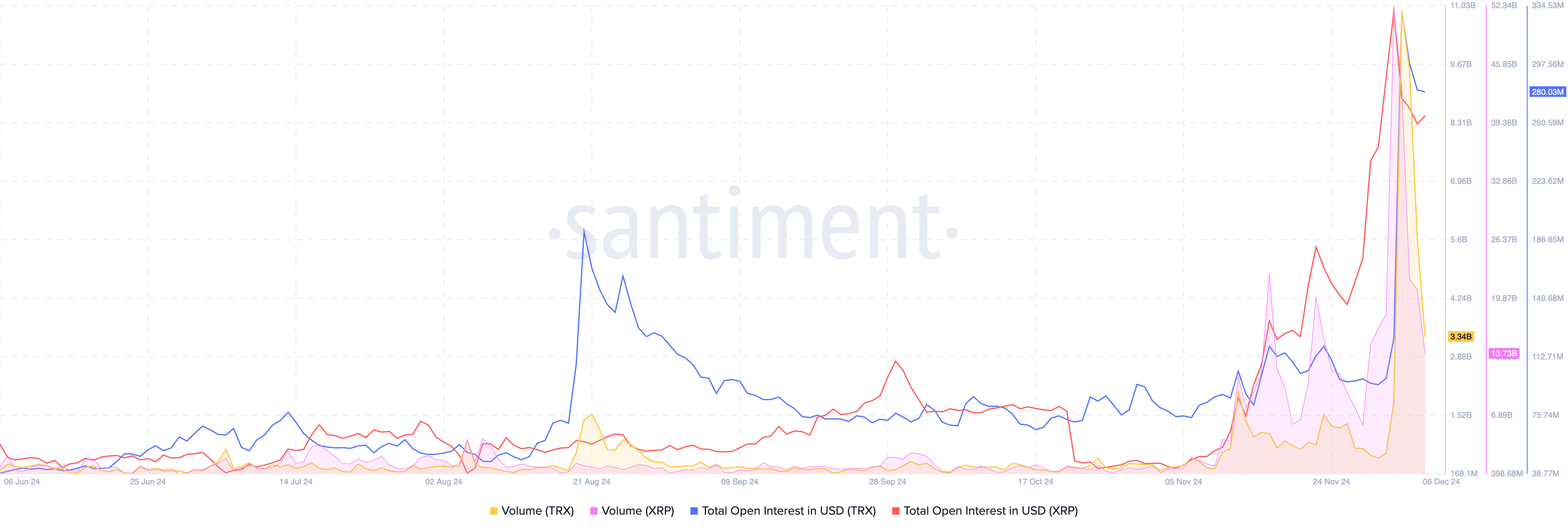

The total open interest in both XRP and TRON was noted to spike earlier this week. Open interest tracks the active positions in the token across derivatives exchanges. A spike in the metric was followed by above-average open interest as of Friday, December 6, per Santiment data.

The volume in both altcoins is above average, with positive spikes in early December, as seen in the Santiment chart below. This shows demand and relevance among traders on crypto exchange platforms.

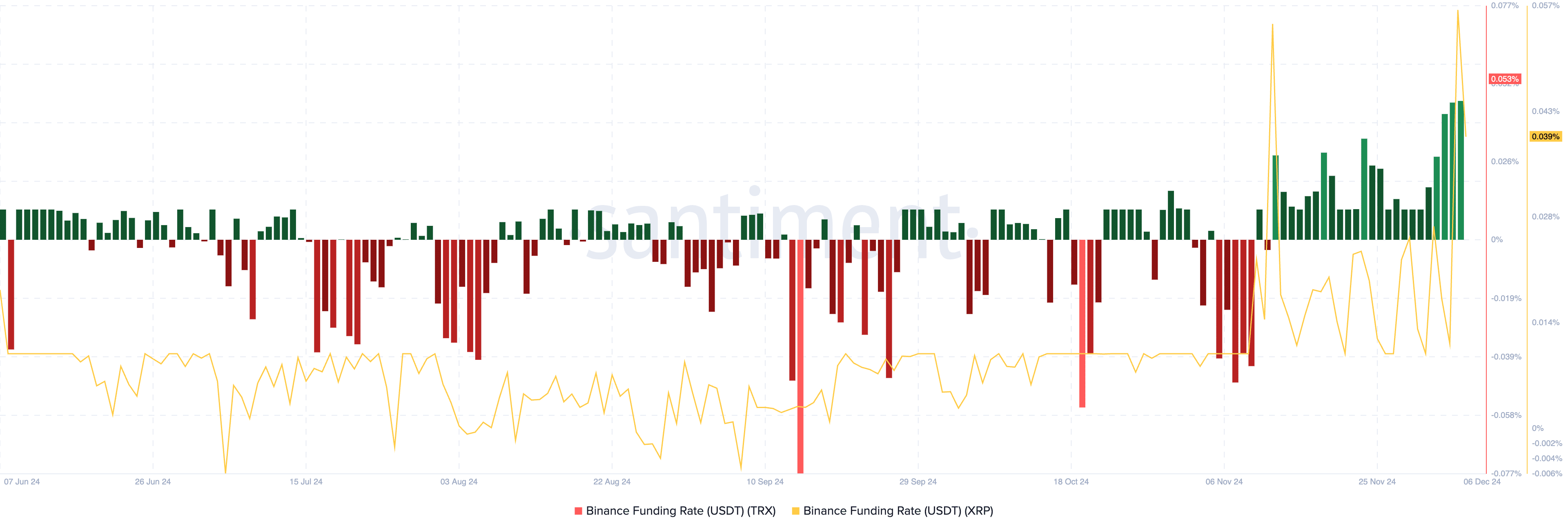

For both altcoins, the funding rate has been positive since November 12. A positive funding rate is indicative of bullish market sentiment among XRP and TRON traders on derivatives exchanges.

XRP and TRON price forecast

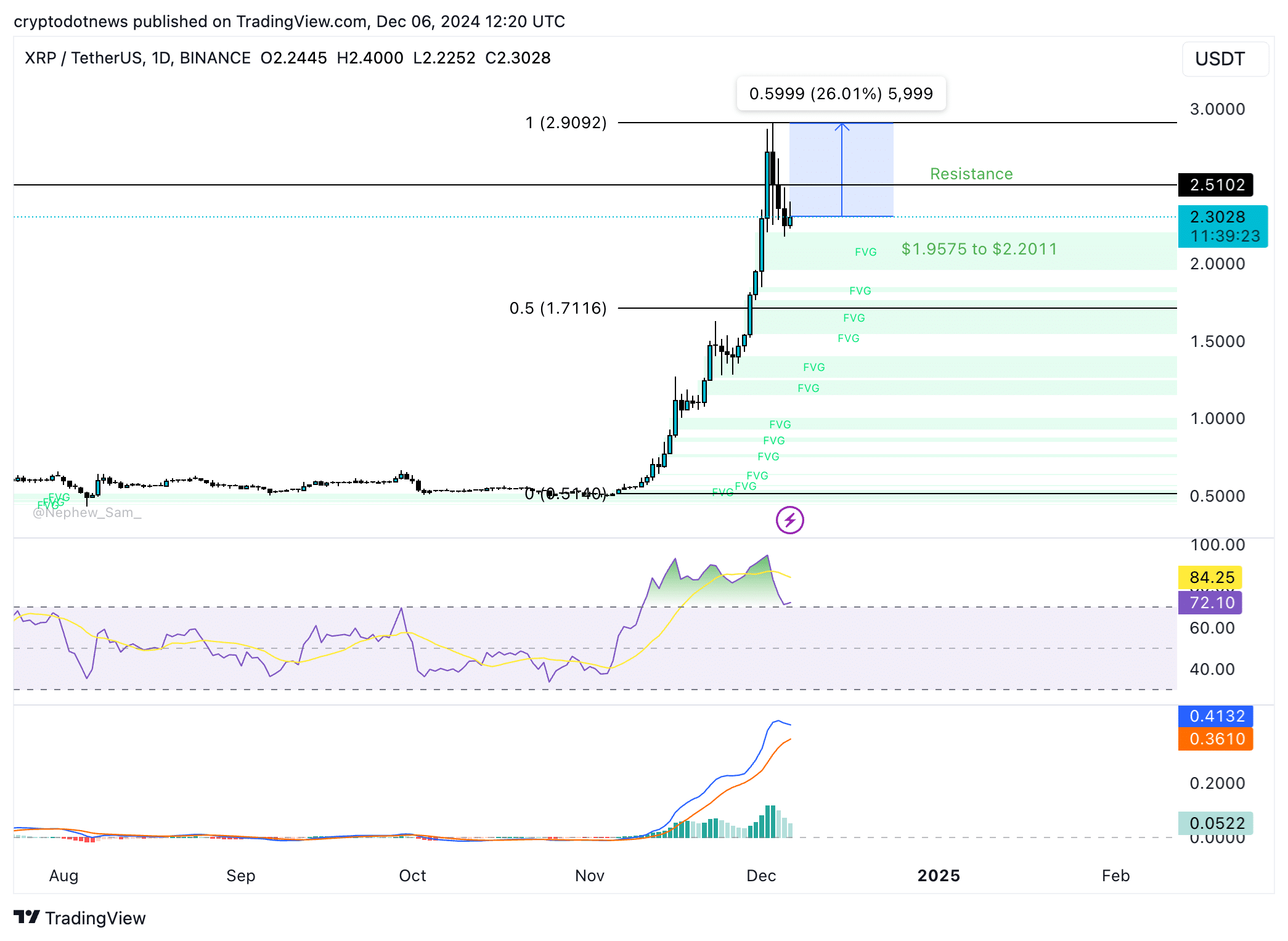

XRP trades at $2.3028 early on Friday. The altcoin’s technical indicators, Relative strength index and moving average convergence divergence are supportive of gains in XRP price.

XRP faces resistance at $2.5102, and the target is the December 2024 peak of $2.9092. A correction could send XRP to collect liquidity in the imbalance zone between $1.9575 and $2.2011.

Once the inefficiency is filled, XRP could attempt to regain lost ground and target a 26% price rally to the target.

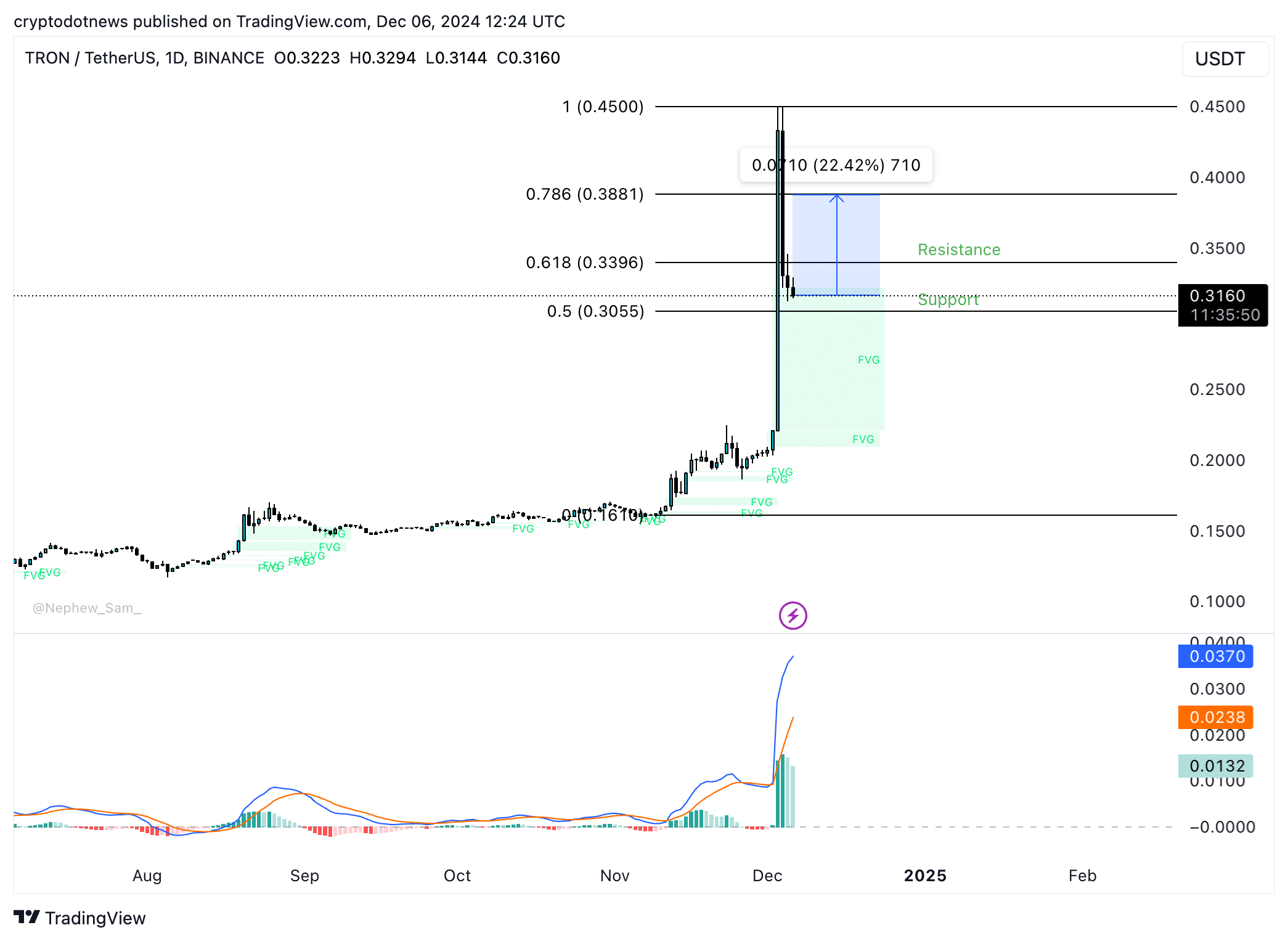

TRON trades close to support at $0.3160 on Friday. The closest support is $0.3055, the 50% Fibonacci retracement of the rally from the November 9 low to the December 4 peak of $0.4500.

TRON could rally 22.42% and target the 78.6% Fib retracement at $0.3881. The altcoin faces resistance at $0.3396, the 61.8% Fib retracement level, as seen on the daily price chart.

The momentum indicator, MACD supports a thesis of gains in TRON as it flashes green histogram bars above the neutral line.

Strategic considerations

Bitcoin’s price trend is key, and traders need to watch BTC closely for an impulsive correction. A steep decline could usher a pullback in altcoins; therefore, sidelined buyers and traders adding to their long position need to watch BTC price.

XRP and TRON both have observed a decline in their open interest across derivatives exchanges in the past 24 hours, per Coinglass data. This is likely a reaction to Bitcoin’s decline under the $100,000 level.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Palmer Legals Reaching Your Expectation

Palmer Legals Reaching Your Expectation